Be strong and courageous, because you will lead these people to inherit the land I swore to their forefathers to give them. Be strong and very courageous. Be careful to obey all the law my servant Moses gave you; do not turn from it to the right or to the left, that you may be successful wherever you go. Do not let this Book of the Law depart from your mouth; meditate on it day and night, so that you may be careful to do everything written in it. Then you will be prosperous and successful.”

- Joshua 1:6-8

“’Teacher, which is the greatest commandment in the Law?’ Jesus replied ‘Love the Lord your God with all your heart and with all your soul and with all your mind.’ This is the first and greatest commandment. And the second is like it: ‘Love your neighbor as yourself.’ All the Law and the Prophets hang on these two commandments.”

- Matthew 22:36-40; note also that these two commands are taken from Deuteronomy 6:5 and Leviticus 19:18

“I am the Lord your God, who brought you out of Egypt, out of the land of slavery.

- You shall have no other gods before me.

- You shall not make for yourself an idol in the form of anything in heaven above or on the earth beneath or in the waters below…

- You shall not misuse the name of the Lord your God, for the Lord will not hold anyone guiltless who misuses his name.

- Remember the Sabbath day by keeping it holy. Six days you shall labor and do all your work, but the seventh day is a Sabbath to the Lord your God. On it you shall not do any work…

- Honor your father and your mother, so that you may live long in the land the Lord your God is giving you.

- You shall not murder.

- You shall not commit adultery.

- You shall not steal.

- You shall not give false testimony against your neighbor.

- You shall not covet…anything that belongs to your neighbor.”

- Exodus 20:2-17 (numbering added)

“Jesus called them together and said: ‘You know that those who are regarded as rulers of the Gentiles lord it over them, and their high officials exercise authority over them. Not so with you. Instead, whoever wants to become great among you must be your servant, and whoever wants to be first must be the slave of all. For even the Son of Man did not come to be served, but to serve, and to give his life as a ransom for many.’”

- Mark 10:42-45

“When you enter the land the Lord your God is giving you, and have taken possession of it and settled in it, and you say, ‘Let us set a king over us like all the nations around us,’ be sure to appoint over you the king the Lord your God chooses. He must be from among your own brothers. Do not place a foreigner over you, one who is not a brother Israelite. The king, moreover, must not acquire great numbers of horses for himself or make the people return to Egypt to get more of them, for the Lord has told you, ‘You are not to go back that way again.’ He must not take many wives, or his heart will be led astray. He must not accumulate large amounts of silver and gold.

When he takes the throne of his kingdom, he is to write for himself on a scroll a copy of this law, taken from that of the priests, who are Levites. It is to be with him, and he is to read it all the days of his life so that he may learn to revere the Lord his God and follow carefully all the words of this law and these decrees and not consider himself better than his brothers or turn from the law to the right or to the left. Then he and his descendents will reign a long time over his kingdom in Israel.”

- Deuteronomy 17:14-20

“This is what the king who will reign over you will do: He will take your sons and make them serve with his chariots and horses, and they will run in front of his chariots. Some he will assign to be commanders of thousands and commanders of fifties, and others to plow his ground and reap his harvest, and still others to make weapons of war and equipment for his chariots…

He will take the best of your fields and vineyards and olive groves and give them to his attendants. He will take a tenth of your grain and of your vintage and give it to his officials and attendants. Your manservants and maidservants and the best of your cattle and donkeys he will take for his own use. He will take a tenth of your flocks, and you yourselves will become his slaves.”

- I Samuel 8:11-17

“The word of the Lord came to me: Son of man, prophesy against the shepherds of Israel; prophesy and say to them: ‘This is what the Sovereign Lord says: Woe to the shepherds of Israel who only take care of themselves! Should not shepherds take care of the flock? You eat the curds, clothe yourselves with the wool and slaughter the choice animals, but you do not take care of the flock. You have not strengthened the weak or healed the sick or bound up the injured. You have not brought back the strays or searched for the lost. You have ruled them harshly and brutally. So they were scattered because there was no shepherd, and when they were scattered they became food for all the wild animals.”

- Ezekiel 34:1-5

“The thief comes only to steal and kill and destroy, but I have come that they may have life, and have it abundantly. I am the good shepherd. The good shepherd lays down his life for the sheep. The hired hand is not the shepherd who owns the sheep. So when he sees the wolf coming, he abandons the sheep and runs away. Then the wolf attacks the flock and scatters it. The man runs away because he is a hired hand and cares nothing for the sheep. I am the good shepherd. I know my sheep and my sheep know me.”

- John 10:10-14 (Jesus speaking about himself)

“Feed my sheep.”

- John 21:15-19 (Jesus said this to the Apostle Peter three times as a description of the way he wanted Peter to lead the church).

“Be sure to set aside a tenth of all that your fields produce each year…At the end of every three years, bring all the tithes of that year’s produce and store it in your towns, so that the Levites (who have no allotment or inheritance of their own), and the aliens, the fatherless and the widows who live in your towns may come and eat and be satisfied, and so that the Lord your God may bless you in all the work of your hands.”

- Deuteronomy 14:22-29 (and see also similar passages in Deuteronomy 26:12-13 and Numbers 18:20-30)

“At the end of every seven years you must cancel debts. This is how it is to be done: Every creditor shall cancel the loan he has made to his fellow Israelite. He shall not require payment from his fellow Israelite or brother, because the Lord’s time for canceling debts has been proclaimed. You may require payment from a foreigner, but you must cancel any debt your brother owes you.”

- Deuteronomy 15:1-3

“Count off seven sabbaths of years – seven times seven years…Consecrate the fiftieth year and proclaim liberty throughout the land to all its inhabitants. It shall be a jubilee for you; each one of you shall return to his family property and each to his own clan…If you sell land to one of your countrymen or buy from him, do not take advantage of each other. You are to buy from your countryman on the basis of the number of years since the Jubilee. And he is to sell to you on the basis of the number of years left for harvesting crops. When the years are many, you are to increase the price, and when the years are few, you are to decrease the price, because what he is really selling you is the number of crops…The land must not be sold permanently, because the land is mine and you are but aliens and my tenants.”

- Leviticus 25:8-34

“Do not muzzle an ox while it is treading out the grain.”

- Deuteronomy 25:4

“…The worker deserves his wages.”

- Luke 10:7

“And to you experts in the law, woe to you, because you load people down with burdens they can hardly carry, and you yourselves will not lift one finger to help them.”

- Luke 11:46

“Everyone must submit himself to the governing authorities, for there is no authority except that which God has established. The authorities that exist have been established by God. Consequently, he who rebels against the authority is rebelling against what God has instituted, and those who do so will bring judgment on themselves. For rulers hold no terror for those who do right, but for those who do wrong. Do you want to be free from fear of the one in authority? Then do what is right and he will commend you. For he is God’s servant to do you good. But if you do wrong, be afraid, for he does not bear the sword for nothing. He is God’s servant, an agent of wrath to bring punishment on the wrongdoer. Therefore, it is necessary to submit to the authorities, not only because of possible punishment but also because of conscience.

This is also why you pay taxes, for the authorities are God’s servants, who give their full time to governing. Give everyone what you owe him. If you owe taxes, pay taxes; if revenue, then revenue, if respect, then respect; if honor, then honor.”

- Romans 13:1-7

“Then they called them in again and commanded them not to speak or teach at all in the name of Jesus. But Peter and John replied, ‘Judge for yourselves whether it is right in God’s sight to obey you rather than God. For we cannot help speaking about what we have seen and heard.’

- Acts 4:18-20

“Peter and the other apostles replied: ‘We must obey God rather than men.’”

- Acts 5:29

“Give to Caesar what is Caesar’s, and to God what is God’s”

- Matthew 22:21

“Each man should give what he has decided in his own heart to give, not reluctantly or under compulsion, for God loves a cheerful giver.”

- 2 Corinthians 9:7

“It is for freedom that Christ has set us free. Stand firm, then, and do not let yourselves be burdened again by a yoke of slavery.”

- Galatians 5:1

“By their fruit you will recognize them. Do people pick grapes from thornbushes, or figs from thistles? Likewise every good tree bears good fruit, but a bad tree bears bad fruit. A good tree cannot bear bad fruit, and a bad tree cannot bear good fruit.”

- Matthew 7:16-18

“Government is not reason; it is not eloquent; it is force. Like fire, it is a dangerous servant and a fearful master.”

- George Washington

‘If men were angels, no government would be necessary.”

- James Madison

“Democracy and socialism have nothing in common but one word, equality. But notice the difference: while democracy seeks equality in liberty, socialism seeks equality in restraint and servitude.”

- Alexis de Tocqueville

“The American Republic will endure until the day Congress discovers that it can bribe the public with the public's money.”

- Alexis de Tocqueville

“Power tends to corrupt, and absolute power corrupts absolutely.”

- Lord Acton

In order to properly understand what the Bible says about the role of government, it is essential to start with the appropriate context or framework. And the most important aspect of that is to understand that the Bible does not explicitly either endorse or critique any particular political system. This is because the Bible is not primarily a political work. Rather than achieving a specific political purpose (the effects of which would necessarily be confined to particular times and places, and be less effective in some cultural contexts than others), the Bible is intended to address the much broader topic of the proper relationship between mankind and God (and also the related topic of how we should treat one another), and to offer a message of spiritual hope and salvation to all people, in all times and places. Thus, the Bible is primarily a theological work, and not an explicitly political one.

Partly for the sake of achieving its primary spiritual objective of offering a message of spiritual hope and salvation to all people, in all times and places, and partly because even crude forms of political order are generally preferable to disorder and the risk of anarchy, the general rule laid down in the Bible is that believers should submit to the governing authorities (Romans 13:1-7). The exception is that, when the secular government specifically orders believers to disobey the commands of God, then the governing principle should be “we must obey God rather than men.” (Acts 5:29)[1] The determination as to exactly where the proper boundary is between obeying the laws of man and obeying the law of God is left to each individual’s conscience. (“Give to Caesar what is Caesar’s, and to God what is God’s” – Matthew 22:21) However, we are warned not only in Romans 13:1-7, but also in the capsule history of the early New Testament church given in the Gospels and the book of Acts, and in the history of ancient Israel given in the first half of the Old Testament that disobeying the secular government is likely to be costly in every way. Therefore, if and when we decide to disobey the secular government, we need to be sure that we are doing it for a reason that is worth the cost. Or as the Declaration of Independence puts it, “Prudence, indeed, will dictate that Governments long established should not be changed for light and transient Causes.”

However, with all of the above said, there are many principles of good government that can be deduced from a careful reading of the Bible, that seeks to understand both a) what principles of good government are implied by the general spiritual themes and principles that are consistent throughout the Bible (the “First Principles” of a Biblical worldview discussed in an earlier section of this site), and b) also what implicit political principles (or political commentary) exist in the more historical passages of the Bible (primarily the history of ancient Israel, given in the books of Genesis – 2 Chronicles, which comprise approximately the first half of the Old Testament.)

As noted earlier, the Bible does not explicitly endorse any particular political system. Therefore, the application of its implicit political principles to any particular political situation requires a significant amount of interpretation, and will always be a matter of some controversy. However, this does not mean that Christians (regardless of their political beliefs or political affiliation) should fail to even try to apply Biblical principles to our political problems. In fact, quite the reverse is true. Although the Bible is primarily concerned with the Kingdom of God, and Jesus did say, “My kingdom is not of this world” (John 18:36), all Christians are also commanded to pray, “Your kingdom come, your will be done, on earth as it is in heaven.” (Matthew 6:10) And although that is primarily a spiritual statement, it definitely has some political implications as well. And Christians are also called to be salt and light (Matthew 5:13-16), which among other things means to both help preserve and help enlighten secular society.

Due to the amount of interpretation required to form a coherent picture of what the Bible has to say on political issues, I believe it is essential both: a) to start with a clear understanding of the “First Principles” of a biblical worldview (i.e, the general spiritual themes and principles that are consistent throughout the Bible), and b) to present the broadest possible overview of what the Bible has to say about political issues. On this second point, I am following one of the most important general principles of interpreting scripture: that “scripture interprets scripture,” or in other words, that each specific scripture should be interpreted not only in its immediate context, but also in the context of what the whole Bible says.

By following these two principles, I hope that really major errors of interpretation can be avoided, so that most of the remaining debate is about how to apply Biblical principles to a specific political situation, rather than whether the principles themselves are valid. I also want to make it clear at this point that, while this site contains many specific policy proposals and what I believe to be the Biblical rationale for them, the primary objective of this site is really to educate people about what a Biblical worldview is and show them what it might look like in practical terms to apply these principles to America’s current political issues, rather than merely to advocate a specific political program.

Below is what I believe to be a reasonably good summary of the first principles of a Biblical (or Jude-Christian) worldview, along with some very brief notes on how these first principles apply to political issues. This material is covered in much more detail in the First Principles section of this site.

First Principles of a Biblical (or Judeo-Christian) Worldview

- The Authority of the Bible: The Bible claims to be a divinely inspired and authoritative guide to both spiritual and moral life. This site focuses on the Bible as a guide to what America’s Founding Fathers called the “natural law” (which is in fact our common morality, that we all know in our hearts is right), and leaves detailed discussion of our religious duties to religious organizations (and/or to each individual’s conscience.) In other words, this site focuses primarily on applying Biblical morality (i.e., Biblical standards for how we treat one another) to political issues, and leaves detailed discussion of our duty to God to religious organizations (and/or to each individual’s conscience.)

- Love is the Supreme Virtue: Obviously, this has many implications, but they are summarized in Jesus’s two commandments, or in the Ten Commandments. The Ten Commandments speak to the fundamental problem of governance, which is balancing freedom and order. Since love itself requires freedom of moral choice, proclaiming love as the supreme virtue implies a strong commitment to individual freedom. However, love also requires distinguishing between right and wrong.

- A Commitment to Individual Freedom: A strong commitment to individual freedom is one of the major themes that runs all the through the Bible, from Genesis all the way to Revelation. This is one of the things that makes the Bible unique, especially by comparison with other texts on governance (either ancient or modern), and it is one of the major reasons for the success of the societies that have been most influenced by the Judeo-Christian worldview. However, the fact that God has given us extensive freedom of moral choice does not mean that all moral choices are equally valid or equally meritorious.

- The Rule of Law: The Bible states clearly that one of the keys to a just and prosperous society is that society should be ruled by a system of laws, to which everyone is subject, rather than by the arbitrary whims of individual men. Under the American Constitutional system, the concept of the rule of law has been broadened to also include the separation of government powers. In other words, in addition to being accountable to the law in general, government officials should be careful not to exceed the legal powers of their own office.

- A Commitment to Truth: Truthfulness and trustworthiness are foundational to all human relationships. Our entire system of commercial law is an attempt to codify, systematize, and fairly apply the idea that we should keep our promises to one another, rather than lying, cheating, or deceiving one another. The Bible teaches that discernment (the process of distinguishing truth from falsehood, or good from evil) works best with God’s help. However, since the pursuit of truth does not necessarily require a spiritual context, it provides a middle ground on which the sacred and the secular can meet.

- An Acknowledgement of Mankind’s Great (and Permanent) Moral Imperfection: In stark contrast to secular humanism, both the Jewish and Christian scriptures teach that humanity has deep moral imperfections[2], which will last throughout our lives on earth, and that therefore, when we attempt to live apart from God, we will inevitably fall into severe evil. An unbiased review of human history would seem to suggest rather strongly that the Judeo-Christian view of human nature is more realistic than the secular humanist view. Man’s inhumanity to man is one of the most consistent themes of history, and throughout the course of recorded history, man’s inhumanity to man has cost hundreds of millions (if not billions) of lives.

- A Commitment to Justice: Justice means equity and fairness. It is both a responsibility of conscience and a legal responsibility. In the context of civil society, justice means doing our best to ensure (to the extent that this is possible through a code of law), that the rules by which society is supposed to operate are clearly defined, fair, and equally and impartially applicable to everyone, rich or poor, male or female, and of any race.

Since there is much that is subject to interpretation in applying the Bible to political issues, another important principle of this process is to “judge a tree by its fruit.” (Matthew 7:16-18) In other words, in evaluating any political idea (not just those based on Biblical principles) we should be practical and pragmatic, and make good use of scientific data and other empirical data to determine how well each idea actually works in practice. The best ideas are likely to be those that have both a) some grounding in Biblical principles, and b) also some support in scientific or other empirical data. Or as stated in the portion of the First Principles section of this site on “A Commitment to Truth,” since the pursuit of truth does not necessarily require a spiritual context, it provides a middle ground on which the sacred and the secular can meet. And conversely, any idea, policy, or ideology which requires us to deny scientific or other empirical truths is likely to be a bad one. This entire site is to some extent written on the basis of an appeal to (and explanation of) both Biblical and scientific truth, as well as some discussion of how they fit together.

The history of Israel also has many important things to teach us about God’s principles of governance. God’s original plan for the government of ancient Israel (which is explained primarily in the first seven books of the Bible, Genesis-Judges) emphasized limited government (and thus was intended to produce freedom and prosperity in Israel.)

To fully understand the extent to which the Bible supports the principle of limited government, it is essential to remember that all of the commands in the Bible are intended to function within the context of Jesus’s two commands (Love the Lord your God with all your heart, soul, and mind, and love your neighbor as yourself – Matthew 22:36-40), or the fuller statement of the same principles in the Ten Commandments (Exodus 20:2-17.) Both of these passages make it clear that love is the supreme virtue. And since love is a personal decision, or an act of free will, a strong commitment to individual freedom is clearly implied in the idea that love is the supreme virtue.

The brevity of the Ten Commandments, and the nature of the Commandments, also provide a strong implicit endorsement of the principle of limited government. Rather than trying to explicitly regulate every detail of the ancient Israelites’ lives, the focus of the Ten Commandments was on defining the necessary boundaries between freedom and order (which is the key question of governance that any free society has to answer.) This strongly implies that the focus of our modern secular laws should be on defining the right boundaries (i.e., prohibiting those activities which are clearly and by popular consensus detrimental the maintenance of a free society), rather than on regulating the economy (or any other aspect of our lives) in great detail. Or in other words, one of the key principles of limited governance is: “If it is not prohibited (and the list of regulations should be kept short), then it is allowed.”

And the Ten Commandments have stood the test of time. Thirty-five centuries later (and despite the best efforts of many governments around the world to edit God out of the picture), there is still no better answer to the question of how to define the necessary boundaries between freedom and order than those found in the Ten Commandments.

The Bible’s strong commitment to individual freedom, and the closely related idea that governing institutions exist to serve God’s people (rather than the other way around), are among the most important points that set the Bible apart from every other religious or political text throughout history. Not only has the Bible brought a message of hope and inspiration to many individual lives, but the principles taught throughout the Bible give us lots of guidance on how to maintain a society that values, protects and encourages individual freedom (and thus the dignity and prosperity of individuals, in both spiritual and material senses, and in both this world and the next.)

The Biblical account of the history of ancient Israel provides further evidence of the Bible’s commitment to the idea of limited government. During the earliest part of the history of Israel (i.e., beginning with Moses and Joshua), the primary government was the priesthood, and the other officials under the priests, who were responsible for leading Israel in worship of the Lord, and performing the sacrifices and other observances commanded in the Law of Moses. The priests appointed “judges” to help them settle disputes among the people (Exodus 18:13-27) A tithe, plus various smaller additional offerings, was considered sufficient for the needs of both religious and secular government, including caring for the poor (Numbers 18:20-30; Deuteronomy 14:22-29; Deuteronomy 26:12-13) During this period, there was no standing army in Israel, and armies were mobilized as needed, on what would today be called a “militia” basis, to fight various enemies. (For several examples of this, see Judges chapter 1.)

This is the context for God’s famous warning to the people of Israel in I Samuel 8:11-17 , in which the Israelites are warned not to appoint any secular king at all, for two reasons:

1) The king would require many Israelites to serve him on a permanent (or at least long-term) basis, either in the military or on the king’s own estate, and

2) The king would require Israel to pay a second tithe (in addition to what they were already paying for the temple and all the services it provided, which were the only governing institutions they had needed before.)

“This is what the king who will reign over you will do: He will take your sons and make them serve with his chariots and horses, and they will run in front of his chariots. Some he will assign to be commanders of thousands and commanders of fifties, and others to plow his ground and reap his harvest, and still others to make weapons of war and equipment for his chariots…

He will take the best of your fields and vineyards and olive groves and give them to his attendants. He will take a tenth of your grain and of your vintage and give it to his officials and attendants. Your manservants and maidservants and the best of your cattle and donkeys he will take for his own use. He will take a tenth of your flocks, and you yourselves will become his slaves.”

- I Samuel 8:11-17

In a later period of Israel’s history, after the people of Israel had disobeyed this warning and appointed a king, God clearly warned both the kings and the people to remember that the kings were there to help enforce the Law of Moses, and to serve the Lord and the Lord’s people in other ways. Both the kings and the people were sternly warned against the excesses common to authoritarianism:

“When you enter the land the Lord your God is giving you, and have taken possession of it and settled in it, and you say, ‘Let us set a king over us like all the nations around us,’ be sure to appoint over you the king the Lord your God chooses. He must be from among your own brothers. Do not place a foreigner over you, one who is not a brother Israelite. The king, moreover, must not acquire great numbers of horses for himself or make the people return to Egypt to get more of them, for the Lord has told you, ‘You are not to go back that way again.’ He must not take many wives, or his heart will be led astray. He must not accumulate large amounts of silver and gold.

When he takes the throne of his kingdom, he is to write for himself on a scroll a copy of this law, taken from that of the priests, who are Levites. It is to be with him, and he is to read it all the days of his life so that he may learn to revere the Lord his God and follow carefully all the words of this law and these decrees and not consider himself better than his brothers or turn from the law to the right or to the left. Then he and his descendents will reign a long time over his kingdom in Israel.”

- Deuteronomy 17:14-20 (and see also a somewhat similar passage in Joshua 1:6-8)

The broader context for these two passages is the entire Biblical account of the history of Israel, which is given primarily in the first half of the Old Testament (the books of Genesis-Deuteronomy, Joshua, Judges, 1-2 Samuel, 1-2 Kings, and 1-2 Chronicles.) Although none of these passages explicitly endorse any particular political system, when considered in their entirety they offer a strong implicit critique of authoritarianism. According to these accounts, there were a total of 42 kings of Israel (the unified nation), Samaria (the “Northern Kingdom” of 10 northern tribes), or Judah (the “Southern Kingdom,” consisting of the tribes of Judah and Benjamin, near Jerusalem) between the time of Saul and the exile of Judah to Babylon. This is a period of approximately 400 years, from about 1000 BC to 586 BC. Throughout this 400-year period, only 13 of the 42 kings (counting generously[3]), or less than one-third, did what was right in the eyes of the Lord. The rest did evil, and some of the evil kings practiced assassination or child sacrifice (see I Kings 16:8-26 and 2 Kings 16:1-3 for examples.)

And why did this happen, in a relatively small nation, with an early tradition of limited government, which claimed to have received its entire moral and spiritual tradition from God Himself? Based on the accounts in 1 and 2 Kings, and elsewhere in the first half of the Old Testament, there seem to have been two answers, which are somewhat related. First, the temptation to continue worshipping the old pagan gods that had preceded God’s covenant with Israel (thus violating the first commandment of the Law of Moses, “You shall have no other gods before me”), was always there. This was closely related to the second temptation, which was to go one’s own way in spiritual matters, so as not to be constrained by the high standards of the Law of Moses. In other words, by refusing to put God first in their lives, the evil rulers of Israel abandoned any sense of accountability to God, and ended up abandoning the most basic level of personal integrity, and becoming vulnerable to doing severe evil, as a result. Or, put more simply, and in a way that is more directly relevant to modern public policy, the saying that “power corrupts, and absolute power corrupts absolutely” is really true.

Another analogy that is commonly used in both the Old and the New Testaments to describe either political or spiritual leadership is the analogy of shepherds leading sheep. (See Ezekiel 34:1-5, John 10:10-14, and John 21:15-19 for examples.) The task of the shepherd is to protect and care for the sheep. In other words, this is another restatement of the fact that governments should exist for, and work for, the benefit of those being governed.

The only other economic regulations included in the Biblical plan for the governance of ancient Israel (beyond the very limited items already discussed), were a few additional specific rules that that were intended to demonstrate God’s special concern for the poor. One of these was that the land God had allotted to each of the tribes of Israel could not be permanently sold, but only (in effect) leased for a varying number of years, until it reverted to its original owner at the time of the Jubilee that occurred every fifty years (Leviticus 25:8-34.) Since ancient Israel was a small and densely populated country, in which most of the population depended on subsistence agriculture for their livelihood, the intent of this regulation was to keep the wealthiest and most successful farmers from acquiring undue power over their fellow citizens by monopolizing control of the land. Thus, it was analogous to our modern anti-trust laws, which are also aimed at preventing monopolies or other excessive concentrations of market power.

Another law required the cancellation of debts every seven years (Deuteronomy 15:1-3.) Since ancient Israel (like most countries reliant on subsistence agriculture), would likely have been a fairly cash-poor society, the intent of this law appears to have been to keep debts incurred during an emergency (such as crop failure) from becoming an excessive long-term burden to the poor. As such, this passage is analogous to our modern bankruptcy laws.

Another very important principle of Biblical governance, which is stated in both the Old and the New Testaments, is that everyone should be able to keep most of what they earn. The Old Testament version of this principle is “Do not muzzle the ox while it is treading out the grain” (Deuteronomy 25:4) and the New Testament version says “the worker deserves his wages.” (Luke 10:7) And the context for these verses is that, during the earliest times in ancient Israel (i.e., when the governance of Israel was closest to God’s original plan), a tithe, or one-tenth of everyone’s earnings, plus various other smaller offerings, was considered sufficient for the needs of both religious and secular government, including caring for the poor (Numbers 18:20-30; Deuteronomy 14:22-29; Deuteronomy 26:12-13.)[5]

A similar idea is stated a slightly different way in 2 Corinthians 9:7, which says, “Each man should give what he has decided in his own heart to give, not reluctantly or under compulsion, for God loves a cheerful giver.” The context for this passage is that, very early in the history of the church, many members of the church in Jerusalem were in dire financial need, because both the Jewish and Roman authorities in Jerusalem were persecuting the church. So the Apostle Paul, in the course of his missionary travels, collected an offering from the churches in Macedonia and Corinth (and possibly others as well), to aid those in need in Jerusalem. But even in this time of crisis, Paul was careful to emphasize that the giving should be voluntary (because otherwise it would not be an act of love, since love itself is a freely chosen act of the will.)

So God’s model for the church (and by implication, for secular society as well), is that our giving to one another should, to the largest extent possible, be voluntary. And this is further reinforced by Galations 5:1, which says “It is for freedom that Christ has set us free. Stand firm, then, and do not let yourselves be burdened again by a yoke of slavery,” and by all of the other passages, from Genesis to Revelation, that identify individual freedom as an important Biblical value. (See the First Principles section of this site on “A Commitment to Individual Freedom” for more detail on this point.)

The New Testament passage which most explicitly discusses the role of secular government is Romans 13:1-7, which reads in its entirety:

“Everyone must submit himself to the governing authorities, for there is no authority except that which God has established. The authorities that exist have been established by God. Consequently, he who rebels against the authority is rebelling against what God has instituted, and those who do so will bring judgment on themselves. For rulers hold no terror for those who do right, but for those who do wrong. Do you want to be free from fear of the one in authority? Then do what is right and he will commend you. For he is God’s servant to do you good. But if you do wrong, be afraid, for he does not bear the sword for nothing. He is God’s servant, an agent of wrath to bring punishment on the wrongdoer. Therefore, it is necessary to submit to the authorities, not only because of possible punishment but also because of conscience.

This is also why you pay taxes, for the authorities are God’s servants, who give their full time to governing. Give everyone what you owe him. If you owe taxes, pay taxes; if revenue, then revenue, if respect, then respect; if honor, then honor.”

Although at first glance this passage appears to grant substantial discretion to secular governments (and, as noted earlier, especially in its historical context this passage does make it clear that disobeying the secular government could be very costly, and is therefore not a decision to be taken lightly at all), this passage also sets important limits on the authority of secular governments. The first limitation on the authority of secular governments is that the only power that is specifically granted to secular governments is the power to “bear the sword” (i.e., the power to keep order and “punish...the wrongdoer”, for the good of all.) In our modern context the power to “bear the sword” would clearly include military and judicial powers, police and other law enforcement powers, and by a minor extension other emergency services such as fire departments, emergency medical services, and other disaster response services. The role of secular government in every other human endeavor is debatable.

And the second limitation on the power of secular government is that God intends that the power of secular government should always be exercised to “do [His people] good.” In other words, a good government is one that commends those who do good, and those who do right should not have to fear the government. Or to state the same idea in a slightly different way, a good government is one that can always be obeyed in good conscience, and if the government ever orders us to do something that is clearly contrary to God’s laws, then the governing principle becomes “we must obey God rather than men.” (Acts 4:18-20, Acts 5:29)

When one considers all of the passages that present Biblical principles of governance, and puts them in the context of the overall, highest commands in the Bible (which are to love God and love one another), and of the other Biblical first principles summarized above, three overall guiding principles for modern governance seem to emerge:

- Some governance is always necessary to restrain man’s natural depravity.

- However, since from a Biblical perspective governments exist to protect the rights, freedom, and interests of individual citizens, and limited governance is best, Biblical governance must include a strong commitment to individual freedom. This is powerfully evident both in the history of ancient Israel (in which the wretched excesses of un-Biblical authoritarianism are very well documented), and in the modern history of the United States. For all of its problems (which are examined in some detail throughout this site), the United States is still the freest and wealthiest large country in the world (and thus, I would argue the most successful large country in the world, from both spiritual and material perspectives.) And I believe that it is impossible to explain how our modern society could have been created on a continent that was completely wilderness 400 years ago, and was still largely wilderness even as recently as 150 years ago[6], without acknowledging that our commitment to individual freedom and other Biblical principles of governance (which are the main things that have historically distinguished America from other countries, and the true root of “American Exceptionalism,”) are a central part of the story.

- Not only freedom of religious expression, but also the free exercise of religion (or the right to live according to one’s faith, which is supposed to be our Constitutionally guaranteed right), are essential to the maintenance of a free society. This is because all true religions[7] advocate voluntary self-restraint (and voluntary submission to the God-given moral order.) The more that genuine spiritual community influences both the private and public lives of a nation’s citizens, the less need there is for coercive measures by the government. Encouraging voluntary self-restraint both a) removes an important part of the theoretical justification for authoritarian regimes (i.e., that “only a strong central authority is able to maintain order,” and b) actually maintains order better than any government (either democratic or authoritarian) is able do it. These principles (and the other benefits of the free exercise of religion, even within an increasingly secular society) are discussed in more detail in the “Rights of Conscience” section of this site.

For the past 400 years, the preservation of individual freedom has been at the heart of America’s political system, and the worldviews of both its ordinary citizens and its political leaders. And to a large extent, this tradition of placing a high value on individual freedom is inherited from the Judeo-Christian worldview.

This is in stark contrast to socialism, which even within its more democratic manifestations has strong authoritarian tendencies. The ideology of socialism is explicitly and unashamedly based on using various forms of governmental compulsion (high rates of taxation and government regulation, and enforced participation in expensive social welfare schemes within the more democratic systems, and also uglier means elsewhere) to force people to serve an alleged “greater good” that the elite decides upon. This is the real significance of the Brexit vote. The Brexit vote was a rebellion by the British people against the European Union’s socialist bureaucracy in Brussels, which has become increasingly authoritarian, imperial, and unaccountable to the voters. And in American domestic policy, the hidden authoritarianism (and gross economic inefficiency and stupidity) that are often at the heart of even the most democratic forms of socialism can best be explained by an analysis of Obamacare, which is discussed in detail in the Healthcare section of this site.

According to the Judeo-Christian worldview, the key task of governance in a free society is to define the appropriate boundaries between freedom and order. (This is shown most clearly in the Ten Commandments, but in many other passages as well.) In other words, when governing from Judeo-Christian point of view, we should thoughtfully ask ourselves what is the minimum amount of explicit or outward governance required to accomplish a particular task, and constantly endeavor to preserve the high degree of freedom that God intends for all of us to have. In this connection, it would be very useful for all of us to remember what George Washington said about the nature of secular government: “Government is not reason, it is not eloquence, it is force. Like fire, it is a dangerous servant and a fearful master.”

The discussion of the American vs. European systems of taxation that follows is fairly extensive, but there is a good reason for that. The level of tax burden in any given society (i.e., the percentage of personal and national income that the government commandeers) largely defines the amount of freedom that society has, in both political and economic terms. A higher tax burden equals less freedom, and a lower tax burden equals more freedom. And as we will see in a minute, freedom and prosperity (in both economic and spiritual senses) are intimately connected. More freedom clearly and demonstrably equals more prosperity. And God wants us all to be free and prosper.

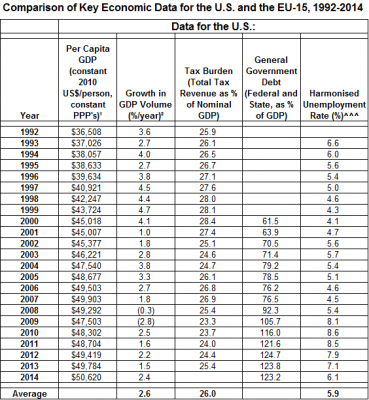

As we will see in a minute, since 1992 the average tax burden assessed by federal, state, and local governments on American citizens has averaged 26% of income, while the equivalent figure for western Europe is almost 40%. And although reduction of America’s federal budget deficit is necessary, and some minor further expansions of America’s social safety net[8] may be necessary as well, we would be well advised to keep as much of our freedom as possible.

The economic value of America’s strong historical commitment to individual freedom can be clearly seen by comparing the performance of the American and western European[9] economies over the entire life of the European Union (1992-2014, 2014 being the latest year of data available in its entirety.)

In almost every category, this comparison strongly favors the United States. As of 2014, per capita income[10] was 37% higher in the United States than in the EU-15 ($50,620 in the United States compared to $36,870 for the EU-15.) Over the entire 1992-2014 period, real economic growth[11] in the United States averaged 2.6% per year, one full percentage point (or 63%) higher than the EU-15 average of 1.6% per year. And over the entire 1992-2014 period, unemployment in the 19-country Euro Area[12] averaged 11.1%, very nearly double the United States average of 5.9%.[13]

All of the above figures are measures of economic opportunity (or in the case of the unemployment rate, the lack thereof.) The significance of the per-capita income figures, and the unemployment figures, is obvious.

What may be less obvious to some readers is the extent to which the rate of economic growth has a real-world impact on future economic opportunities for ordinary working people. While the relationship between economic growth and job creation depends on many factors, and can vary significantly over time even within a single economy, it can be quantified. One major study indicates that, between 1991 and 2003, the employment elasticity of economic growth in the United States averaged about 0.45.[14] Thus, if economic growth in the United States had averaged 1.6%/year rather than the actual figure of 2.6%/year over the 1992-2014 period (a 63% reduction in economic growth), then job creation in the United States most likely would have been reduced by about 0.63 x 0.45, or about 28%. Since the U.S. economy added a total of about 2.5 million jobs over the past 12 months (August 2015 – July 2016), a 28% reduction in job creation would equate to a reduction of about 700,000 jobs per year.

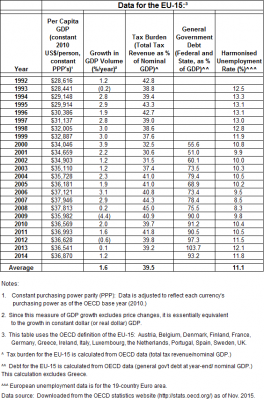

And one of the primary reasons for Europe’s much lower rate of economic growth is shown in the “tax burden” column of the table. On average over the 1992-2014 period, Europeans paid 39.5% of their income in taxes, which means they faced a tax burden more than half again as high as the U.S. average of 26%. More specifically, if every American paid taxes on the European scale, then every American’s total tax bill would have to be 52% higher than it currently is. And even that understates the impact of the European scale of taxation on ordinary working families. Beyond a certain level of total tax burden, it becomes impossible to shield the lowest-earning households from taxation (as the American system currently does to a significant extent.[15]) So if the U.S. continues to move towards enacting European-style social welfare programs, most of the cost of funding those programs will have to be borne by ordinary working-class and middle-class families (not due to punitive intent on anyone’s part, but just as a result of the basic economic reality that there are many more working-class and middle-class households than upper-income households.)

The reality of this can be seen by comparing the U.S. and European systems of taxation in a bit more detail. As of mid-2015, France, Germany, and the United Kingdom (which collectively account for more than half of the EU-15’s total GDP) all had top income tax rates of 45%, which, once the impact of state income taxes is accounted for, is essentially equivalent to the top U.S. federal tax rate of 39.6%. (Unlike the United States, many European countries, including Germany and the UK, do not have state-level or provincial income taxes. Aside from local levies, most of the tax collection in Europe is done by the national governments.)

So at a macro level, the major difference between the systems of taxation in the U.S. and western Europe is that, in the United States (which has no national sales tax), the combined state and local sales tax rates averaged about 6.5% as of January 1, 2016, while in the EU-15, standard rates for the Value Added Tax (VAT, which is conceptually similar to a sales tax[16]) ranged from 17% to 25% as of January 31, 2016. [17] Thus, in western Europe, most economic transactions are anywhere from 10.5% to 18.5% more expensive than in the U.S., due to the impacts of taxation alone. And therefore, on average over time there are significantly fewer economic transactions per capita in western Europe, leading to lower economic growth, fewer job opportunities, and lower per capita incomes. And since the VAT is paid by every European citizen, most of the difference in tax burden between the U.S. and European taxation systems falls on ordinary working-class and middle-class families.

Although it is possible to some extent to make “social justice” arguments for so-called “progressive” or “redistributive”[18] systems of taxation (in which the wealthy pay a higher tax rate than the average citizen), these arguments are more closely aligned with the Marxist principle of “from each according to his ability, to each according to his need”[19] than with Biblical principles. The only system of taxation explicitly endorsed in the Bible is the tithe, which is a proportional tax that required each citizen to pay 10 percent of their income (Numbers 18:20-30; Deuteronomy 14:22-29; Deuteronomy 26:12-13)

There are several important reasons why proportional taxation is the only system of taxation explicitly endorsed in the Bible. The first reason is a moral one: assuming their funds are honestly and legally acquired, every worker is entitled to enjoy the fruits of their own labor (Luke 10:7, “the worker deserves his wages.”) The second reason is both moral and practical: if everyone pays approximately the same tax rate, that forces all of us to have a more honest discussion of how high taxes should be, and what government services should be provided in return for those taxes, because everyone is forced to consider these questions in terms of what services they would be willing to raise their own taxes to pay for, rather than assuming that they can somehow magically get someone else to pay for government programs that benefit them. And (as noted in the First Principles section of this site on “A Commitment to Truth,”) the Bible clearly tells us that honesty is the foundation of trust in all relationships. In other words, a flatter tax code will also tend to be a fairer and more transparent tax code. If tax rates are kept relatively low, then economic success will depend more heavily on what you know and how hard you work. If tax rates are relatively high, then economic success depends more on negotiating exemptions to the tax code (i.e., on politics and “who you know.”)

And finally, there is another important practical consideration as well. As will be discussed in more detail in the remainder of this “Role of Government” section of the site, proportional taxation can raise greater amounts of revenue more efficiently (and thus with less negative impact on the economy), than any other system of taxation.

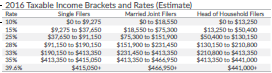

The inefficiency of the income tax system can easily be seen by comparing the effective tax rate (total tax actually collected, as a percentage of personal income) with the statutory or marginal tax rates (the published tax rates applicable to each level of income, which are summarized in the table above.[20]) As shown in the table, the published federal income tax rates for 2016 range from 10% in the lowest bracket to 39.6% in the highest bracket. However, there are so many tax exemptions and tax deductions (at all income levels[21]) that the effective tax rate for the federal income tax is slightly less than 10%.[22] This has several important implications for future tax policy:

1) When it comes time to pay the bill ourselves, we have all implicitly agreed that an effective tax rate of about 10% is a fair rate for the federal income tax (which is a striking confirmation of Biblical principles on this subject.)

2) Broadly speaking, the way we have implemented the 10% effective tax rate is that the bottom 45% of households pay no federal income tax, the 46th through 89th percentiles pay an effective federal income tax rate of slightly under 10%, and the top 10% of households pay effective federal income tax rates that average about 20%.[23]

3) The above distribution of the federal income tax burden means that (according to the Tax Policy Center’s data for 2015), the wealthiest 20% if U.S. households paid 87% of total federal income tax revenue, and 69% of total federal tax revenue. [24] (Which is fine by me up to that point, but don’t try to tell me that’s not enough.)

4) Another way of restating points 2) and 3) above is that, hypothetically, if we were to reform the federal income tax system by a) eliminating all of the exemptions and deductions except those for each dependent, for state and local taxes, and for charitable giving, and b) reducing the brackets to three levels, with no change in the first two brackets (which would result in a 0% effective tax rate for incomes up to the 45th percentile when the effects of the earned income tax credit are included, and modest taxes immediately above that), replacing the current 25% bracket with flat rates of 15% for ordinary income and 10% for long-term capital gains[25], and replacing the top four current brackets (28% bracket and above) with flat rates of 25% for ordinary income and 20% for long-term capital gains, we could collect about the same amount of total income tax revenue, with about the same distribution of the tax burden at various income levels, in a far simpler way that would have far less negative impacts on earnings, savings, and investment than our current tax code does. In this hypothetical example, everyone would pay about the same amount of tax at their current income level, but would be able to keep more money if they work more and earn more, which is the key Biblical principle on this subject. In other words, our current, allegedly “progressive,” federal income tax system has been made inefficient for purely political reasons, in order to appear to “punish the wealthy” more than it actually can, does, or should. As discussed later in this section, I think there are two more modest plans for reform of the federal income tax code, that follows the key principles discussed in this example, that would likely be the best l alternatives that are practical at this time.

5) Because of the low effective federal income tax rate, and the extent to which the burden of federal income taxation is already heavily skewed toward the wealthy, even relatively large increases in the federal income tax rates will only produce limited amounts of additional tax revenue, while having significant negative effects on the economy by discouraging increases in earnings, savings, and investment. Both the data from the European countries discussed earlier, and the data from the U.S. confirm this. In other words, in both the U.S. and Europe, the ability of the tax code to redistribute income has largely reached its practical limit.

6) Thus, the implementation of a federal sales tax (which is the most efficient form of proportional taxation), in combination with reform of our entitlement programs, is probably necessary to significantly reduce the federal budget deficit. It would be relatively easy to modify the Earned Income Tax Credit to exempt the neediest households from the federal sales tax. And in addition to helping reduce the federal budget deficit, a federal sales tax would also help reduce our trade deficit.

Points 4) through 6) above are discussed in more detail throughout the remainder of this section.

One key weakness of the current federal and state income tax systems is that they subject businesses of all sizes (small and large) to very high marginal tax rates. According to the Tax Foundation’s analysis, the top marginal corporate income tax rate for large businesses headquartered in the United States is currently 38.9% (consisting of a 35% federal statutory tax rate plus 3.9% for state income taxes), which is considerably higher than either the European Union average of 26.2% or the Asian average of 26.7%.[26] For small businesses that operate in the highest tax federal tax brackets[27] the marginal tax rates are even higher, ranging from 38.5% to 45.1% once an average of 5.5% for state income taxes is figured in.[28] And knowing that 40% or more of your incremental earnings will go to the government (after you have done all the work and taken all the risk of expanding your business), is a substantial deterrent to expanding your business.

Therefore, there is little doubt that a reform of our income tax codes for both individuals and businesses, which moves them further toward the Biblical principle of proportional taxation (or, stated in more modern and detailed terms, follows the principle of applying lower marginal tax rates to a larger base of income), so that people who work more and earn more will be able to keep a higher proportion of their earnings, would be an important factor in increasing future economic growth and employment levels.

And before we get further into the details, it should be noted that a large share of the benefits from a tax reform of this type would go to small businesses (and therefore to ordinary Americans, since small businesses have a greater tendency to be locally owned, hire locally, and purchase the goods and services they need as inputs to their business locally, than large corporations do.)

According to the U.S. government’s Small Business Administration (“SBA”), as of 2013 small businesses (defined as businesses with fewer than 500 employees), accounted for 48% of the private sector employees in the United States (57 million out of 118 million employees), and accounted for 60% of the net new jobs created between 2009 and the third quarter of 2013.[29] More detailed data for 2011 (the latest I could find) shows that about 37% of the total small business employment (or about 21 million jobs) are provided by firms with fewer than 20 employees, and 57% of the total small business employment (or about 32.5 million jobs) are provided by firms with fewer than 50 employees.[30] Thus, enacting tax reform and other policies that benefit small businesses (without damaging the rest of the economy), is one of the keys to increasing America’s overall rates of economic growth and employment growth.

There are currently two proposals for reforming the federal income tax code that I think are closest to implementing Biblical principles, and would ultimately benefit all Americans:

- Incremental Proposal: The original version of this proposal came from Tax Foundation, and I am endorsing it as proposed, with only one exception.[31] This proposal would: a) cap itemized deductions (except for charitable donations) at a total of $25,000 per household, b) reduce the top three federal income tax brackets for ordinary income by 5% each (so that the 28% bracket is effectively extended up to household incomes of about $400,000, and the top two brackets are reduced to 30% and 34.6%), c) reduce the top bracket for long-term capital gains to 20%, and d) reduce the statutory rate for federal corporate income taxes from 35% to 30% (bringing U.S. corporate tax rates closer to the average for the rest of the world.) Because of the cap on itemized deductions, this proposal is essentially “revenue neutral” on a static basis (i.e., at the same income levels, it would reduce total tax collections by only $1.4 billion/year.) However, because of the additional income, economic growth, and employment it would generate, the Tax Foundation expects this proposal to actually increase total federal tax revenues by an average of $76 billion/year over the next 10 years once the growth effects are taken into account. It is also expected to increase economic growth by about 0.3%/year in real dollar terms, and increase employment by about 65,000 jobs per year.

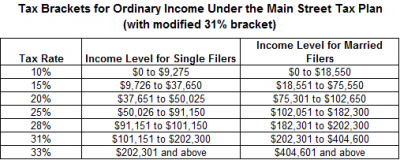

- Comprehensive Proposal: The best proposal for comprehensive reform of the federal income tax code that I have seen thus far is the “Main Street Tax Plan” proposed by the Hudson Institute.[32] This plan is designed to decrease the total federal tax owed slightly for every tax bracket and household size. In general, it works similarly to the other tax reform plans discussed on this site, in that it applies lower tax rates to a larger tax base, by limiting or phasing out many of the tax deductions in the existing income tax code (although not the Earned Income Tax Credit, credits related to healthcare costs, the deduction for mortgage interest on a primary residence, or deductions for charitable giving.) It gives a significant tax break to lower and middle-income households and small businesses by eliminating the Medicare payroll tax. It also significantly restructures the income tax brackets in order to eliminate the “marriage penalty,” and other inequities in how different types of households are treated in the current federal income tax code. Another particular focus of this plan is to boost economic growth by reducing the taxation of new investments by either small or large businesses. This plan also tackles the subject of large business/corporate income tax code reform in more detail than I have seen from any other plan, which is important since the current corporate tax code gives big businesses headquartered in the U.S. substantial incentives to re-invest overseas earnings overseas, rather than investing here in the U.S. On a static basis (i.e., at current income levels), the Tax Foundation estimates that the Main Street Tax Plan would reduce total federal tax revenues by about $100 billion/year. However, this plan is expected to boost economic growth so much (by an average of about 0.8%/year), that it would actually produce a net increase of about $68 billion/year in total federal tax revenues once the growth effects are accounted for. This plan is also expected to increase employment by about 230,000 jobs per year.

- I am endorsing the Main Street Tax Plan with only one minor exception. The minor exception is that, in order to give a small additional tax break to small businesses, I am inserting a 31% tax bracket[33], rather than extending the 33% bracket down to incomes of $101,000 (for single filers) or $202,000 (for married filers) as the original version of the Main Street Tax Plan does. The proposed tax brackets under the “Main Street Tax Plan” (as modified with the inclusion of the 31% bracket) are shown in the table below:

These two tax reform plans provide examples, analyzed using current economic modeling techniques, of the practical economic benefits to every citizen (higher economic growth, higher after-tax incomes, higher employment, and a lower federal budget deficit) that are associated with applying relatively low marginal tax rates to a large tax base. Applying relatively low marginal tax rates to a large tax base (whether the taxation system is perfectly proportional or not) is the best way to put into effect the key Biblical economic principle that “if you work more, you earn more.”

By contrast, Hillary Clinton’s tax plan clearly illustrates the fact that our existing federal income tax code is incapable of raising any significant additional revenue. With one very significant exception (relating to estate taxes), Clinton’s tax plan only raises taxes on households at the top 1% of U.S. income levels (roughly $400,000 and up.) However, Clinton’s plan includes very high tax rates on capital gains (raising the federal tax rates on capital gains received by upper-income households to 47.4% for investments held less than two years, sliding down to a minimum of 27.8% for investments held for six years or more, compared with a maximum tax rate of 24.8% for investments held for one year or more in the current tax code. When average state income tax rates of 5.5% (in the upper bracket) are figured in, the total tax rates on capital investments by upper-income households would range from 33.3% to 52.9% under Clinton’s plan.

Households with incomes in the upper 1% provide slightly more than 30% of America’s total capital investment. Thus, Clinton’s tax plan can only really be described as a recklessly anti-investment plan. The Tax Foundation estimates that Clinton’s tax plan would decrease America’s capital investment by a total of about 3% over their 10-year analysis period (or a decrease averaging 0.3%/year), while the incremental reform plan described above would increase capital investment by a total of about 8% (or 0.8%/year), and the comprehensive/”Main Street” plan would increase capital investment by about 21% (or 2.1%/year.) Thus, if Clinton’s plan is enacted, over the long term substantially fewer businesses would be American-owned than could be the case under a more sensible tax code.

Another part of Clinton’s tax plan that would have a punitive effect on small businesses is her plan to increase the federal estate tax rate from 40% to 45%, and lower the estate tax exemption from $5 million to $3.5 million. The incremental impact of this change would be felt disproportionately by small businesses, rather than by the billionaires she claims to be targeting. Most of the billionaires have already hired battalions of lawyers to help them legally avoid estate taxes. The legal avoidance of estate taxes has become an entire industry, the existence of which implicitly proves that, when it comes time to pay the bill themselves, most Americans consider the estate tax unjust.

So even without lowering the estate tax exemption to only $3.5 million, the burden of the estate tax disproportionately falls on family-owned businesses, that are often less sophisticated in their financial planning than the billionaires. And not only will the estate tax itself take a big chunk out of someone’s inheritance, but the need to pay the estate tax bill can often force the sale of a family-owned business to strangers, during the family’s time of bereavement, and possibly at a distress price (depending on the marketability of a particular business at a particular time.) Things like this are the reasons why God was careful to protect the ancient Israelites’ most important inheritance (the land) from sale or any other form of redistribution (Leviticus 25:8-34.)

Furthermore, the Tax Foundation’s analysis of Clinton’s tax plan[34] indicates that it is expected to raise revenues by only about $50 billion/year on a static basis (i.e., at the same income levels), and that, once the plan’s anti-growth effects are taken into account, the net improvement in federal tax revenues from implementing her plan is likely to be only about $19 billion/year. And the portion of her plan that relates to the estate tax accounts for only one-fifth of these total amounts. At a time when the U.S. federal government’s budget deficit is almost $600 billion per year, Clinton’s plan is clearly vastly insufficient to close the gap. In other words, what Clinton’s tax plan is essentially saying is: not only will we reduce America’s future investment and employment potential, and take away your family-owned businesses, but we will do it for what amounts to no reason! This is a classic example of the arrogance and stupidity of Big Government in action. And the very fact that Clinton would propose such a plan is an implicit admission that the establishment of the Democratic Party is completely out of ideas for improving the American economy.

And there is another factor to consider as well. Once the federal government asserts the power to take away 40% to 50% of the ordinary income, investment earnings, and inheritances from the top 1% of society, it is highly unlikely that the use of these powers will remain confined to the top 1% of society. Or to use a succinct military expression: crap always flows downhill. Abundant proof of this principle can be found in Bernie Sanders’s tax plan for funding a socialized healthcare system, which is discussed in the Healthcare section of this site.

My main concern on this site is to keep the bottom 99% of us free. But in order to do that, we need to allow the top 1% their freedom as well. So while some resentment of the top 1% is certainly understandable given the current state of American society, we need to focus our efforts at reform on drawing the right boundary lines that will prevent the 1% from abusing their power (such as campaign finance reform and reasonable regulation of Wall Street), rather than merely indulging our resentment.

My views on campaign finance reform are summarized on a separate section of this site. And to summarize my views on the proper regulation of Wall Street:

- I am in favor of re-imposing the separation of commercial and investment banking that we used to have in the Glass-Steagall Act. In my opinion, requiring that investment banking operations be separate from federally insured commercial banking operations (and thus requiring the investment banks to assume full responsibility for the financial risks of their operations) is far more important than the relatively minor operational inconveniences that would be associated with separating commercial and investment banking operations.

- “Too big to fail” is a fatally flawed principle, which essentially makes it explicit that there are different rules for small and big businesses. And this is something that the majority of small businessmen heartily resent. The “crony capitalism”[35] of the big banks gives real capitalism (which is one of the keys to America’s success, but is based on the principle that everyone has to assume responsibility for the business risks they take) a bad name.

- The only really effective way to regulate derivatives trading (and the other complex features of Wall Street) is to require the big investment banks to assume full responsibility for the trading risks they run (and thus to allow for the possibility of big investment banks failing.) With the appropriate separations between commercial and investment banking operations back in place, I do not believe this position would pose any significant systemic risks to the banking system. The laws on this subject need to be re-written so that, rather than presuming the government will prevent the failure of a big bank as at present, they only give the government the option to intervene temporarily, and only for the narrow purpose of insuring the orderly liquidation of a failing bank.

- Possibly we might need a Wall Street-wide insurance system that requires investment banks to contribute to an industry-wide insurance fund (at levels agreed between themselves, with the oversight of the Securities and Exchange Commission) if they wish to engage in certain pre-defined forms of risky trading activities (derivatives etc.) Any shortfall in the insurance fund caused by the failure of a big bank would then have to be made up by the other investment banks participating in this high-risk insurance fund. By requiring the big investment banks to meaningfully self-insure (and also to help government regulators understand the true levels of risk associated with various types of trading), we could likely do a better job of avoiding high levels of systemic risk than we have in the past.

Although I have spent considerable time in this section on some details of tax and regulatory policy (that I believe are important to every citizen), I cannot close without briefly referring back to the big picture of the federal government’s budget.

Forecasts of the key items in the budget of the U.S. federal government over the next ten years (based on Congressional Budget Office, or “CBO”, projections as of August 2016) are shown in the table above. The key takeaways from this table are:

1) Despite significant projected growth in federal tax revenues over the next decade, the federal government’s budget deficit is also large, and is projected to grow very significantly over the next ten years. Currently, the federal government’s budget deficit is about $600 billion per year, and this is projected to more than double, to over $1.2 trillion per year, by 2026 if no major changes are made to the federal budget.

2) The growth in the federal deficit is largely driven by growth in mandatory spending (or “entitlement” programs), which are so called because everyone who is eligible for these programs is entitled to certain benefits under the law. By far the largest components of entitlement spending are the major healthcare programs (which consist of Medicare, Medicaid, Obamacare, and CHIP), and Social Security. Both the major healthcare programs and Social Security will have to be reformed significantly (from the perspective of maintaining a large share of the benefits that current participants in these programs receive, while also setting each program on a more sustainable long-term path) in order to reduce the federal debt and the federal budget deficit to manageable levels over the long term. Despite the enactment of Obamacare, the major healthcare programs remain both the largest, and the fastest-growing, portion of federal entitlement spending. My proposals for reform of the healthcare programs are discussed in a separate section of this site.

3) Because of the financial challenges facing our existing entitlement programs, we cannot afford to add any major new entitlement programs until we have accomplished significant reform of the existing programs, and also made significant progress on reducing the federal budget deficit. We are already struggling to keep the promises that have been made to the American people under the existing entitlement programs, and it is essential that we not proceed further down the path of making promises that we will have difficulty keeping.

The size of the federal budget deficit, in combination with the inefficiency of the income tax code that was discussed at considerable length earlier in this section, makes it clear that we cannot meaningfully reduce the federal budget deficit by raising either individual or corporate income taxes. Meaningfully reducing the federal budget deficit will depend on a combination of a) reforming the entitlement programs, and b) either increasing payroll taxes, or enacting a federal sales tax.[36]

When considering the choice between increased payroll taxes and a federal sales tax, a federal sales tax appears to be the better alternative for several reasons:

a) Since total wages and salaries in the United States (about $7.9 trillion/year as of 2015) are smaller than total consumer spending (currently about $12.2 trillion/year as of 2015), the increase in payroll taxes needed to produce a given amount of tax revenue is significantly larger than the sales tax rate that would be needed to produce the same amount of total tax revenue.

b) A federal sales tax would apply equally (although indirectly) to all forms of income, whereas increases in the payroll tax would apply only to wages and salaries.

c) In the past, increases in payroll taxes have been implemented by dividing them into an employer’s share and an employee’s share. This makes increases in the payroll tax appear somewhat less onerous to individual employees of large firms. However, it has a disproportionate negative impact on small businesses, since for many small businesses, both the employer’s and the employee’s share of the payroll tax come directly out of the pockets of the individual or family that owns the business.

Since total consumer spending in the United States was about $12.2 trillion as of 2015, a 1% federal sales tax would generate about $122 billion per year in tax revenue, before considering any exemption for low-income households. The Earned Income Tax Credit could easily be modified to exempt households making 138% or less of the federal poverty level[37] of income from the federal sales tax, by refunding an amount of tax that is equal to (total amount of eligible income * the federal sales tax rate.)[38] This would exempt about 22% of U.S. households from the federal sales tax, but would only reduce the total sales tax revenues by about 8%. Thus, even after the exemption for low-income households, a 1% federal sales tax would raise total tax revenues of about $112 million/year.

Thus, reducing the current federal budget deficit to zero, without making any changes to government programs, would require a federal sales tax rate of about 5%. But of course, a federal sales tax should not be implemented without accomplishing some meaningful reform of both a) the programs that will be funded by the federal sales tax, and b) the federal budgeting process in general. Therefore, my preferred approach would be:

1) Initially use the federal sales tax only as a dedicated funding source for programs for which meaningful financial reform measures, that will reduce the future growth rate of spending in those programs, have been passed. (One example of how this would work is proposed in the Healthcare section of this site. Somewhat similar ideas are also discussed on the Education section of this site with regard to student loan debt, even though that does not explicitly appear in the federal budget.)

2) Set a goal of ensuring that the total tax burden in the U.S. (including federal and state government revenues), which currently stands at about 26% of GDP, does not go above 30% of GDP at the most (and ideally remains lower than that.)

3) Ultimately pass a Balanced Budget Amendment to the U.S. Constitution, which would require that the federal budget deficit gradually be reduced over time, and that after a certain date, the federal budget should be balanced over the course of each four-year presidential term, except during a time of declared war, or some other form of declared national emergency, as declared by a two-thirds vote of both Houses of the U.S. Congress.

Over the long term, I believe a Balanced Budget Amendment to the U.S. Constitution is essential to restore basic honesty to the federal budgeting process. As of 2016, about 15% of our total federal spending is deficit spending. Or in other words, we have all gotten used to receiving an average of about 15% more from the federal government that we pay in. And this is how our Members of Congress keep getting re-elected. (Often their campaign literature explicitly promises that they will get us more benefits from the federal government than we pay in.) And this is also how we have wound up nearly $20 trillion in debt.